Moneydance 2017 Beta

Do you enjoy using beta software on your precious financial records? Yes? Well, then we’ve got some news for you! We’re preparing Moneydance 2017 (yes, skipping right over 2016) and are looking for some brave souls to put it through it’s paces before it’s released to the wider world. We’d like it to be used by a smaller group of people who are interested and able to report any problems.

If you’re interested please join the #moneydance2017beta Slack channel where you can get the download link and report any problems directly to our development team.

Online Banking Privacy and Security

Here at The Infinite Kind we respect your privacy. Most financial software these days “phones home” to report information about yourself or your environment. Many apps even upload your online banking log-in information to their, or a third party’s, servers.

I’d like to clarify something straight away: Moneydance never sends any financial information, statistics, or online banking credentials to any service other than your own financial institution. Your financial data and online banking passwords are only stored encrypted on your computer. If you have enabled syncing, your financial data, but not your online banking passwords, are encrypted before being uploaded, only to the syncing system that you use. Your information is never accessible to anyone unless you copy it and explicitly share it yourself.

This may sound like common sense, but it’s actually unusual. The current trend is personal finance tools that require the sharing of your private financial information with advertisers, unrelated financial services, or simply third party aggregation services. We can assure you that Moneydance will never require such sharing to work. We fiercely believe that your financial information should be secure and only accessible to yourself, your financial institution, and anyone with whom you explicitly choose to share it.

Backstory

Back in the old days (well, the late 90s and 2000s) the predominant method of downloading transactions from a bank via OFX Direct Connect. I’m proud to say that Moneydance was the first indie app to support online banking and bill payment via OFX, and is still one of only a handful that support it.

Open Financial Exchange (OFX) is a standard protocol supported by many banks in the USA. It allows installed apps, such as Moneydance or Quicken, to talk directly to the bank’s servers, download transactions, and manage bill payments. OFX also provides a mechanism for online bill payment: managing payees and creating, modifying or canceling payments.

Some banks provided a more lightweight system in which a desktop app opened an embedded web browser through which you logged into your bank’s web site and downloaded an OFX-formatted file with transaction data. That downloaded data was then intercepted and processed by the app.

The key point is that your passwords were stored locally on your computer and sent only to the bank when a download was requested. There was no middle man and your login credentials stayed private to you and your bank.

Modern Online Banking

Not all banks support direct OFX connections, and some are dropping support for it. In fact, many banks intentionally make it harder for customers to access their data in any way that is readable by software. As a result, companies such as Yodlee have appeared. They thrive on accessing and aggregating financial data and translating it into a software-readable form. They upload and store the user’s online banking credentials and connect to banks by pretending to be the customer, often using a simulated browser. Mint.com was one of their most famous early customers. Mint was subsequently purchased by Intuit, the makers of Quicken. Soon after, both Mint and Quicken were converted to use Express Web Connect, which was Intuit’s version of Yodlee’s service.

These services frequently pretend to be a human sitting at a web browser, logging in to each bank’s web site. They extract the transaction data from the web site or download it directly to their servers where it is aggregated and available to download the next time you connect.

The Problem

These third party services admittedly are convenient; however, there is a huge weakness: you must give them your online banking password, to be stored on their servers. That last statement will set off alarm bells for anyone experienced with online security. Web sites - even the ones to which you login directly - should not be storing your passwords. This is why services with reputable user account systems (Google, Facebook, Twitter, most banks, etc) can never send you your password if you forget: they simply don’t have it. Properly secured services will only store a hash of your password on the server side, not the password itself. I’m confident that third party financial aggregation services such as Intuit’s Express Web Connect and Yodlee encrypt users’ passwords and take security seriously; however, the fact remains that they must possess those passwords in order for their system to work.

I believe there are three main problems here: Lack of privacy with too many people having access to your financial information Potential security problem with third party services holding on to your online banking credentials The fact that customers are often completely unaware of the existence of these third party services and the information they have

Conclusion

Wouldn’t you feel better knowing that the only people who have your bank login details and knowledge of your financial transactions are you and your bank?

Moneydance does not upload your online banking passwords to any service aside from your financial institution. All of your financial information is stored encrypted on your own computer and never shared with any other party services. We mind our own business so you can mind yours.

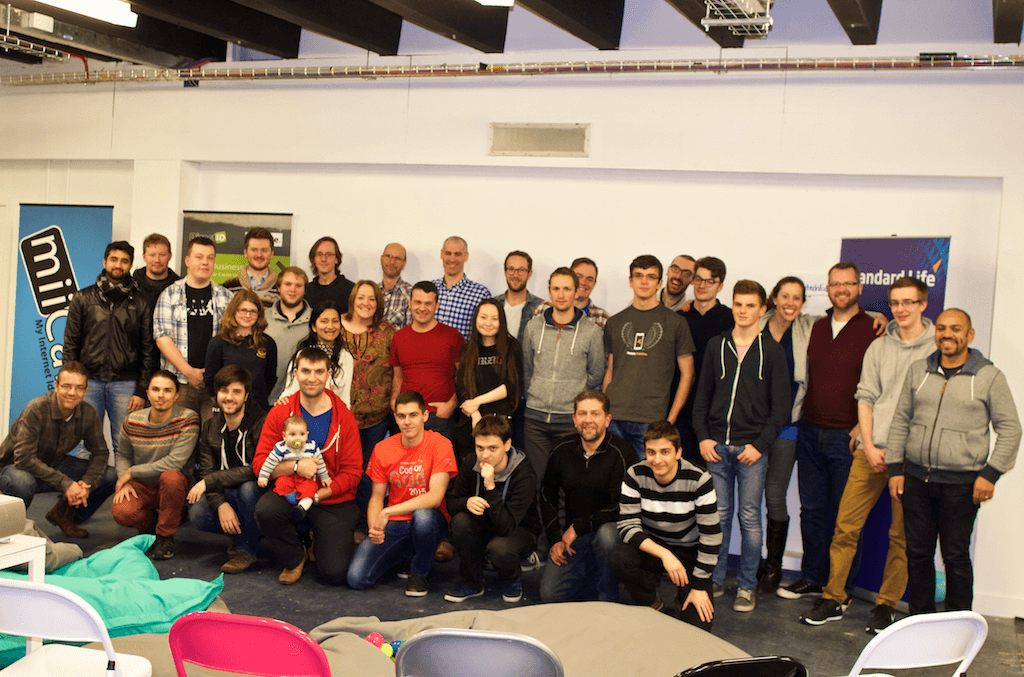

At our finance-themed hackathon hosted at the Deloitte office at the beginning of the month we saw 8 teams make it through to the Sunday night presentations. It’s amazing what a bunch of talented strangers can create in 48hrs when left to their own devices and provided with some mentor support to help guide them when requested. Here is a list of the teams and descriptions of the products designed.

WINNING TEAM

Team Sustainably worked on a charity funding app to allow users to donate to any charity easily and flexibly. A user simply chooses a cause, adds a round-up amount, adds a credit/debit card to the app, and a donation is made automatically with each purchase. Users would get real time updates, impact points, and rewards from partner organisations; and they’d be able to follow favourite brands and celebrities to see which causes they support. The app is targeted at socially responsible, celebrity/brand/fashion-influenced millennials.

OTHER PARTICIPATING TEAMS

Team Undefined - who were only seven weeks into their coding training at skills academy CodeClan - came up with a visual and social savings app to help millennials meet specific savings goals. Users upload a picture of the item they are saving for to serve as a regular, visual reminder. The app links to a user’s bank account and provides a snapshot of savings progress - in the form of a progress bar beneath the image that also displays the percentage saved and number of days remaining until the savings goal is reached. Users share their goal with the network of people who use the app and get advice from the community.

Team Save Gen

Team Save Gen worked on an app that would be like a close friend and finance mentor. The app aims to increase financial confidence in the user, walking them step by step out of debt and towards better financial management habits. Progress is judged by monitoring changes in a user’s feelings and attitudes towards debt, savings etc by using surveys periodically to see how confidence is improving. After judging a user’s state of wellbeing, the app asks the user about financial goals to focus on right away, and offers rewards for positive behaviours. Their app identifies patterns, triggers and influences - not individual amounts. Challenges are issued according to a user’s confidence levels and financial goals: eg. debt reduction or increasing savings etc. Challenges are reduced in scope and scale when a user struggles to pass them.

Team Foreman’s Formulas

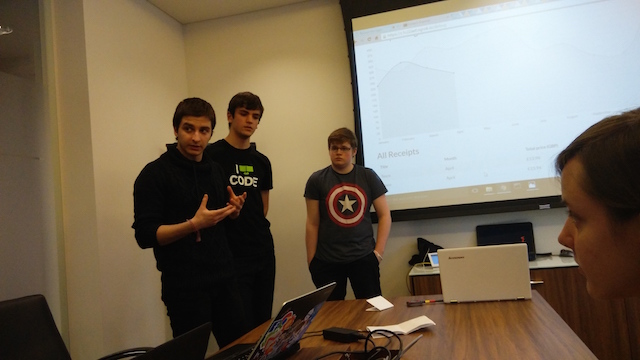

Team Foreman’s Formula also worked on an app to address personal financial management. Their product, called Receipt Manager, tracks a user’s spending and provides information allowing users to make informed decisions about their spending/saving.

Team Smart Budget:

Team Smart Budget gave a live demo of their app in action that had everyone on the edge of their seat! Their app was also aimed at improving personal financial management. It works by tracking spending, providing instant insights, making projections based on spending habits and offering rewards for good behaviour. During their demo they scanned a receipt and their app displayed information about the expense: how much was spent, the name of the store, when, where etc. They also demonstrated syncing across devices.

Team: Pitch Plan Put

Team Pitch Plan Put designed a product that aimed to provide young entrepreneurs with access to funding from local investors.

Team: Urbank

Team Urbank worked on an app designed to educate millennials about personal finance by providing relevant content, and create a savings culture by rewarding good financial habits. Users set a savings goal and arrange to have a set amount of money transferred into their savings account each day. The user is rewarded for this ‘good’ behaviour by accruing base points which would go towards increasing their interest rates. Interest rates would then decrease if the user were to withdraw money from the savings account. This app is designed to work with a banks existing infrastructure but not rely on it.

Team: Scrooge

And finally, Team Scrooge worked on a personal financial management app with two main parts: a dashboard to provide users with visual feedback about their finances, and a ‘brain’ providing predictions of spending on a daily, weekly or monthly basis.

As Kent Mackenzie (Deloitte Scotland) points out in his post-event blog post, we saw the following themes emerge:

- The incorporation of gamification and product simulation into financial products aimed at millennials

- The need for increasing financial confidence and providing financial guidance

- The age of the digital receipt

If you want to see more comments and pictures, check under the hashtag #EdinFintech on Twitter.

This was a terrific collider event and would not have been possible without support from a variety of organisations. Once again, many thanks to:

Our sponsors -

Our mentors: John, Troy, Jacek (Administrate), Kent (Deloitte), Kate (Freeagent), Devon (Glasgow City Council), Waqas (FindMyPast), Sean (The Infinite Kind)

All those who provided much needed hands-on support : Karen & Rhian (Deloitte), Scott (MBN Solutions), and Michelle (The Data Lab).

What happens when you put people with a diversity of skillsets (programming, design, data, marketing) under one roof to work towards an objective, turn up the pressure by adding constraints such as time (48hrs) and team size (3-7) and add heat (you’ll be assessed in front of your peers by a select panel of judges)?

You get an awe-inspiring display of talent and creativity such as the one seen at The Infinite Kind’s second finance-themed hackathon held in Edinburgh just over a week ago (1st-3rd April).

Our event was held at the stunning Deloitte office thanks to Kent Mackenzie. He was a sponsor at our inaugural finance hackathon in November 2015, and was impressed enough to be the first to offer his - and his wonderful team’s - support by offering to host us for this one.

The design of the space was spot-on with a beautiful communal area for socialising, relaxing and filling up on refreshments….

…as well as…

…lovely surrounding rooms for privacy and focussed work, and a large working area for teams that wanted the buzz of working alongside other teams.

The event officially started on the Friday evening at 6.15pm but people came bounding into the venue much earlier, quickly filling the air with an excited buzz as they exchanged ideas over beer and pizza.

Chatter, chatter…buzz buzz :) Happy hackers

The themes for the hackathon were financial products designed for (1) millennials, and (2) the ‘under-banked’ (i.e those excluded from accessing basic financial services).

…

By midnight, teams had planned what they were going to work on over the weekend and left the venue for some rest (hopefully) to prepare them for the intense weekend ahead.

On Saturday morning, the first team arrived at 7.45am! Once again, teams worked until midnight, fine-tuning their ideas, creating designs, writing code, coming across obstacles and chucking out work that had already been in done in order to try another approach etc.

…

Moneydance 2015.7 - one more update before the big one

I’m happy to report that we’ve released the seventh update to Moneydance 2015! We’ve made quite a few improvements in this version, including:

- Improved support for non-western fonts

- Various fixes to the transactions reports

- Option to allow the confirmation popup window to be docked next to the register, a la Moneydance 2014

- Upgraded security settings for connections

- Performance improvements in the budgeting interface

If you’ve purchased Moneydance 2014 or 2015, then this update is completely free. Anyone who purchased an older version of Moneydance gets a 50% off the regular price when upgrading through the website; just a small thank you for being a loyal customer. As usual, we never force you to upgrade Moneydance: old versions will continue working for just as long as you like. We never “sunset” features or services, so if you purchase Moneydance you won’t end up on a never-ending upgrade treadmill.

You can download Moneydance 2015 from our website to get the latest release. If you don’t mind a few minor restrictions (such as not having the extension/plugin installer) you can even purchase Moneydance on the Mac App Store once this update has made its way through the review process.

As always, we welcome your feedback as we work to make Moneydance more amazing! You can get in touch with us by email at or online at infinitekind.com/help.

A weekend of finance & technology - in pictures

Last month we organised our first hackathon and it was awesome! Software developers and designers converged one cold weekend in November to pitch finance-related ideas for making life easier for people and businesses. At the end of 48 hours, four teams, of people who had either previously not met or worked together, presented prototypes and designs which impressed our select panel of judges consisting of industry professionals.

Friday night kicked off with attendees eating their fill of Illegal Jack’s tasty burritos whilst listening to a series of short talks by our speakers and sponsors.

This was followed by ideas being pitched and teams beginning to assemble. By the end of the night four teams had formed and submitted their teams names and product ideas.

Teams arrived at the venue 9am on Saturday morning to continue on the work they’d begun the night before. Mentors from miiCard, Deloitte, Freeagent and Workpro were made available to teams at various times throughout the day.

Hungry hacking and early learning: