The Moneydance crew would like to wish our American users a happy and safe Thanksgiving. We’ll be back to a regular posting schedule next week, including the launch of our second blog series.

There’s an old traveling adage “Set out everything you think you need for a trip, then pack half as many clothes and twice as much money.” I’ve definitely been following these instruction- I left the U.S. with my trusty 24 liter Eagle Creek Iver daypack and a small tote/purse. Being able to carry my gear comfortably, and the time I save by being able to carry-on my luggage, have been well worth the smaller wardrobe. It also means that there’s very little slack in the system- if I lose or destroy one of my two pairs of trousers I need to replace them immediately.

When I was creating my budget for this trip I decided I wouldn’t budget for these unplanned expenses- replacing a lost train ticket, going to the doctor, or getting my glasses fixed. Instead I took the advice of Ramit Sethi, one of my favorite personal finance bloggers, and created a slush fund. I didn’t want to complicate my banking situation, so I decided to use Moneydance to create and track my slush fund.

First, a brief clarification. I’m referring to this as a “slush fund,” which I consider distinct from my emergency fund. My emergency fund is reserved for things like a serious illness, an emergency plan ticket home in case of a disaster, or my partner being laid off. It requires some effort on my part to access. My slush fund is for smaller, less serious things which aren’t included in my budget, or an unplanned for but much wanted indulgence. It is easily accessible at any time using my debit card.

Psychologically, it was important to me to not see this money in my checking or savings account. This prevents me from thinking of money that is available for me to spend, and discourages me from spending it for frivolous reasons. I did not want to set it up as a sub-account of my checking account because then the amount held in my slush fund would appear in the overall balance of the parent (checking) account. To this end I created a new account and named “BoA Mistakes” so that it would display immediately below my checking account in the sidebar. (I’ve edited out the account balances in this screenshot).

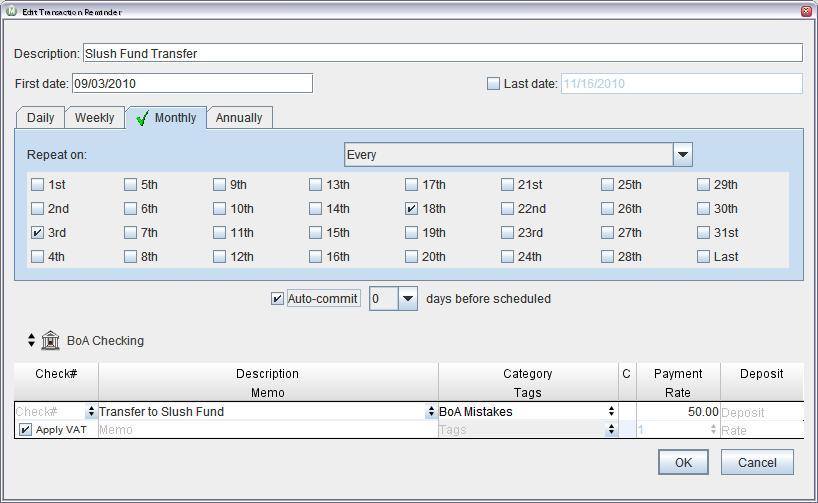

I also wanted to automate the process of putting money into the account so I wasn’t tempted to spend it on a pedicure instead of transferring it to my slush fund. To avoid temptation I’ve create an automatically applied reminder which transfers funds from my checking account to my slush fund. The reminder occurs twice a month the day after I get paid.

When I draw on my slush fund for a major expense, such as a new pair of glasses, I’ll generally try to cut my expenses for the next few weeks to “pay back” the account. In that case I’ll add a one-time reminder to transfer additional money to my slush fund.

Next week I’ll be posting my October budget review, including a sneak peek at a new report we’ve been working on. We’ll also be starting a second blog series next week, so keep an eye open for more details.

I’ve been in Europe for a little over a month and am now happily settled in Avignon for the month of November. Staying in hotels and guesthouses for so long makes settling in novel- I can buy more food than I can eat in 3 days, I have a fully equipped kitchen, and I’ve got a living room AND a bedroom. The south of France is stunningly beautiful, walking out my front door is a bit like walking through a movie set- sweet couples walking hand in hand, fresh crusty bread from the bakery on the corner, cobblestone streets.

Our blog series has been gaining viewers over the past few weeks, and I thought we’d do a brief review of the tips and features we’ve highlighted so far.

Thanks for coming with me on this journey, it’s been an amazing trip so far and there’s more to come!

I’m in Brussels today, and I’ve been on the road for 4 weeks. I’ve visited 7 cities in 3 countries, and it’s been an exciting and wonderful ride. Moneydance support person Jon and I re-connected Wednesday in Rotterdam, and we’re off to Paris on Sunday and Avignon on Monday. On Monday I arrive in Avignon where I’ll settle down for the month of November. I’m looking forward to not having to pack every three days!

Being in one place generally means I’ll save money on groceries and eating out, but I’m also more tempted by indulgences like pedicures and gorgeous French clothing. I don’t want to deny myself all of these indulgences, but seeing prices in currencies which I’m unaccustomed to often makes it more difficult for me to evaluate how expensive something really is. Luckily for my budget I had a brainstorm last month- what I really want to know is “How long do I have to work to pay for this?”

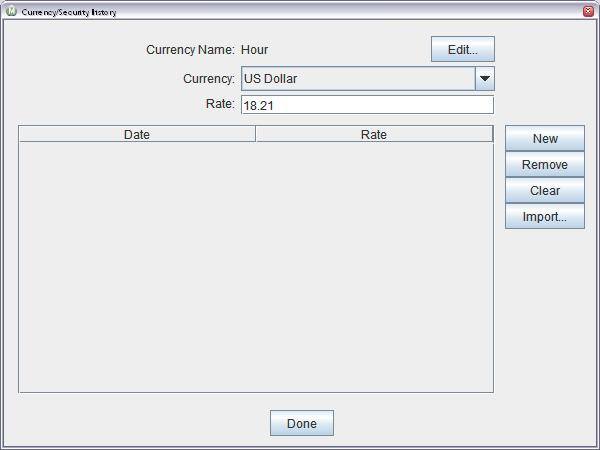

First, I created a custom currency called “Hour.” I manually set the exchange rate for this currency as the amount I get paid per hour. (I don’t actually get paid 18.21 per hour, I’m just using it for demonstration purposes).

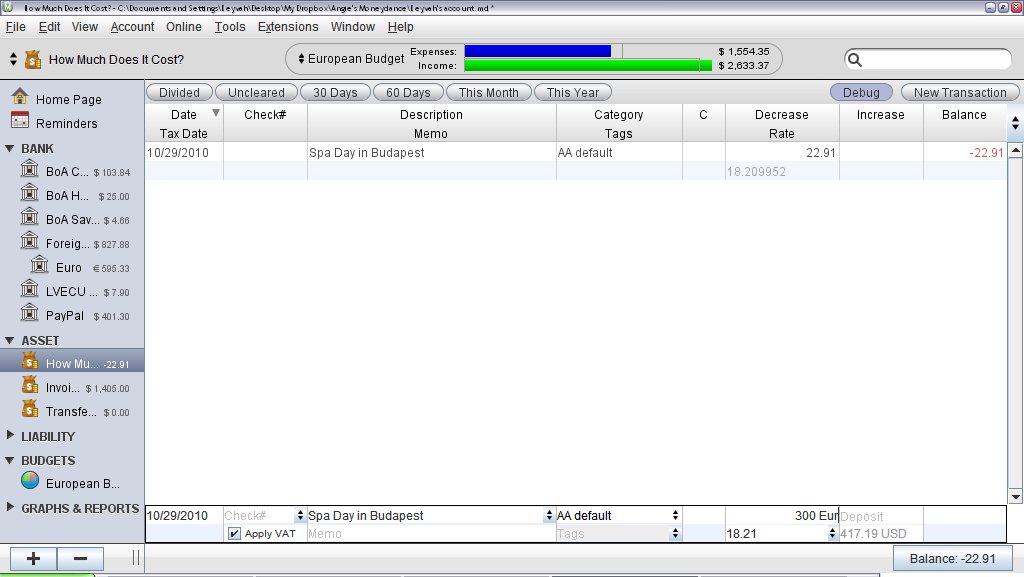

Next, I created an asset account called “How Much Does it Cost?” with a base currency of Hour. When I’m thinking of making a big or especially indulgent purchase I open the account, enter the amount of the purchase with the appropriate currency id (200 Usd, 300 Eur, etc), and hit enter. Moneydance converts the price of my indulgence into the number of hours I’ll need to work to pay for it.

I’ve found this to be a great decision making tool. I might want that gorgeous pair of boots in Paris, but do I really want to work 10 hours to pay for them? On the other hand, while the spa day I’m planning in Budapest will cost me about 15 hours of work I consider it a fair trade off. If it’s a particularly large or long term purchase I might move cash or apply particular hours of my work time to the asset account, gradually “earning” the indulgence.

I’m also a huge fan of the Translate Currencies tool, available under the Tools menu, which lets me see at a glance how much certain amount equals in every currency in my data file. In this example I see that $100 USD equals 62.90 British Pounds, 11,168 Icelandic Krona, or .1619 shares of Google. This is particularly useful when I’m moving to a new currency and am trying to adjust my mind-set to the new exchange rate.

My past two posts have been about ways I use Moneydance in non-traditional ways to better meet my needs. If you’ve created a system or structure in Moneydance to track unusual functions like rental property or frequent flyer miles I’d love to hear about it!

The information in this blog posts is only meant to detail my experience and should not be considered financial advice.