How Apple's Java Announcement Impacts Moneydance

Moneydance is written in a programming language known as Java. As many of our Mac customers know, Apple released an update to Java yesterday (mentioned by John Gruber) with some interesting news in the release notes. The notes say that Apple is “deprecating” their implementation of Java on Mac OS X and may stop including that implementation in future OS releases. Given this news, some of our customers have indicated their concern for Moneydance’s future on the Mac. Allow me to explain why this announcement will not negatively affect Moneydance on the Mac.

First, for the last decade Apple has been the only major desktop operating system vendor to maintain their own version of Java. Because Apple’s core focus is not on Java, their versions have consistently been a release or two behind Windows and Linux. Oracle “owns” Java and has produced top-notch implementations of Java for Windows, Linux and Solaris and now has a strong interest in making sure Java is well supported on the Mac. It seems logical that Java on the Mac will be better off in the hands of the many companies whose interests are aligned with having a great up-to-date implementation of Java for the Mac. In other words, this could be a huge win for Java on the Mac.

Second, there are many companies, including Apple, that rely heavily on Java for Mac OS X. The back-end to the iTunes Store, the Apple Store and many other services are written using Apple’s own WebObjects, which is implemented entirely in Java. Oracle, IBM, and many other companies all have crucial apps written in Java. At almost any developer conference you’ll find a sea of MacBook Pros running Eclipse and other Java-based IDEs. Whatever you think of Apple, they are not going to discard such a large and dedicated developer- and customer base in one fell swoop. There will be Java on the Mac for many years to come, whether it is open source, provided by a large company, or both.

Third, Moneydance is far more than the language in which it is written. If Java on the Mac is truly killed off, Moneydance will be released as a Cocoa (ie native Mac) app. We’ve had the core bits of Moneydance implemented in Objective-C and Cocoa since about 2003, but it’s never been necessary to break it out. We believe Java is currently still the best technology for this kind of application and will stick to it for as long as it is viable, but losing Java on the Mac is not a dead end for us or our customers.

We will continue to produce Moneydance for Windows, Linux, and especially Mac OS X, using the best tools available. We’re flexible enough to adapt to the latest technologies in order to provide our customers with the best experience possible. We appreciate the support of the Mac community and look forward to continuing our long-term relationship.

[Update 2010-11-12] It seems that the best possible outcome is being realized. I think this news from Apple and Oracle is the best thing that could have happened to Java on Mac OS X.

Dealing with delayed transfers

I’m writing from sunny (or not so sunny) Nottingham, where I have a spectacular view of the castle from my hotel room. My absolute favorite thing about England is the Marks & Spencer food hall- it’s a delightful mix of basic supplies and posh pastries with a bit of everything in between. It reminds me of my years living in Manhattan, where caviar and ramen noodles sat cheek-by-jowl in the grocery store. I’m very glad for my budget graphs right now, as I could easily break the bank on pastries alone.

Before I set off on my trip I set up two bank accounts (each with a debit card) at two different banks. Having two funding sources means I’m protected in case one of my banks freezes my account, which is fairly common when traveling internationally. The bank is trying to protect my interests from fraud, but that doesn’t do me much good if I’m stuck without cash in a foreign country.

I’m currently using my PayPal account and debit card, as well as a checking account with a major U.S. bank. When my paycheck is deposited into my checking account I transfer a portion of it into my PayPal account. This transfer generally takes 3 business days, so it can take up to a week for the transfer to be completed. During this time the transfer amount is not available in either account, and I want my account balances to reflect this fact.

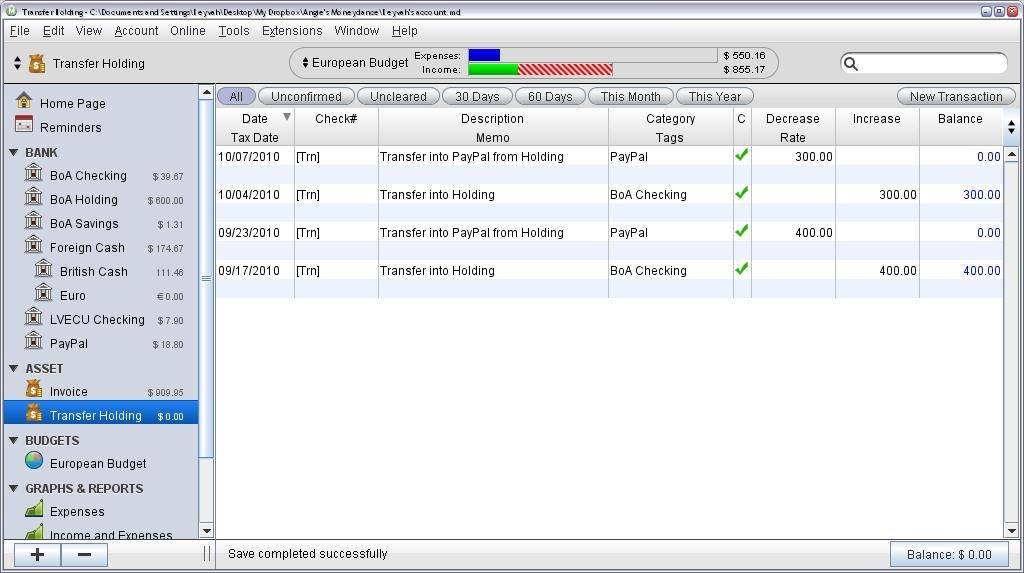

To get around this transfer conundrum I’ve created an asset account called “Transfer Holding.” (I discussed how I use bank vs asset accounts in a previous post at two different banks) When I initiate a transfer I transfer the funds into my asset account. I also create a transaction reminder which I set to auto-commit a deposit to my PayPal account on the day the transfer will be completed.

Now I’ve got everything I want- a clear record of the transfer, keeping the amount of the transfer visible in my net worth, and automatic entry of the second half of the transfer into the appropriate account.

The information in this blog posts is only meant to detail my experience and should not be considered financial advice.

The Moneydance Team welcomes a new member!

The Moneydance Team would like to congratulate Sean, 4.5 year old India, and most especially his wife Jess on the arrival of Angus Alexander Reilly (aka Sandy) on October 5. Weighing in at over 8 pounds and 21 inches long, we’re sure it won’t be long until Sandy is giving his parents and big sister a run for their money!

Liability accounts are a real asset when traveling!

I’m still in Iceland and very much enjoying my stay in Reykjavik, although I have not once managed to spell it correctly without the help of spell-check. Thus far my travel buddy Jon, another Moneydance support person, and I have walked along the harbor, seen what seems like thousands of beautiful wool sweaters, visited Iceland’s only flea market, and visited two different baths.

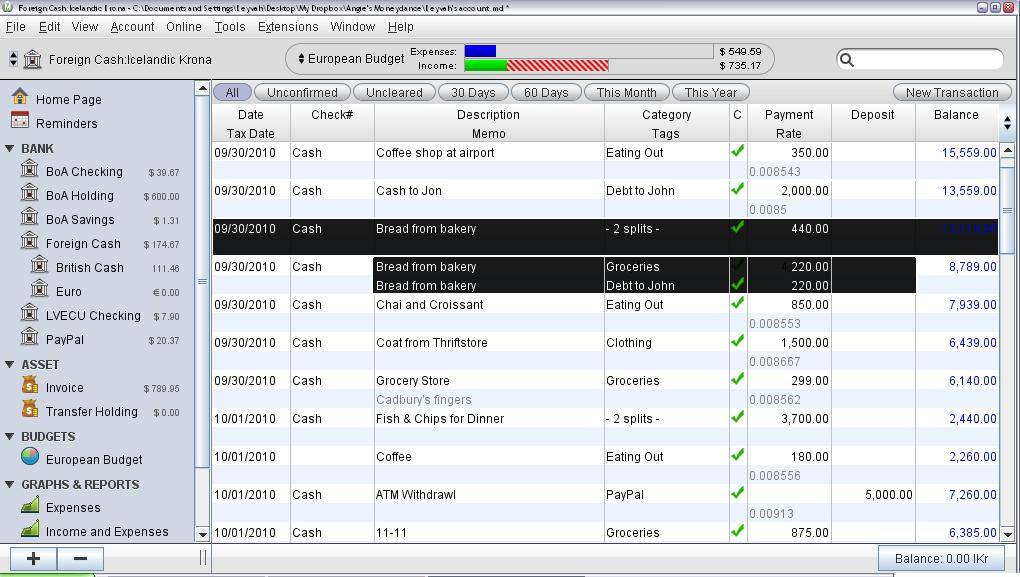

I’ve really been appreciating Moneydance during my trip, especially when it comes to using different currencies. Having the cash account in Krona has been invaluable, in large part because the setup of my cash accounts with a parent account in US dollars and child accounts in the various foreign currencies. This means I can see at a glance both how many Krona I have and what it’s value is in a currency I am more familiar with.

This is also the first long-haul trip I’ve done with only a netbook and my iPod touch, and no full-sized computer (hence the smaller screenshots on these blog entries). While I’ve been using the iPod touch app some, I’m equally likely to whip out my netbook to track the afternoon’s transactions directly through the desktop program. I imagine this will change later in the trip when I’m doing more shopping or taking a day trip with a smaller pack.

I’ve also been experimenting with the use of a liability account for the first time on this trip, as I don’t have a mortgage or car loan. When we arrived in Iceland Jon paid for the hotel room on his debit card and we agreed I would pay him back by paying his portion of our shared expenses (such as meals out, groceries, bus fare, etc). To this end I created a liability account. I entered the initial balance as zero and entered the “debt” transaction with the category of “Lodging” so I could accurately track my expenses. When I spend cash on our shared expenses I use the split transaction function and enter my portion as the appropriate category- lodging, food, entertainment, etc, and Jon’s portion as a transfer to the liability account.

It’s been a breeze tracking the expenses in this way, and also helps us to avoid the “No, it’s your turn to pay for coffee, I’m sure I’ve paid you back by now” quarrels that can happen to friends who travel together but do not share expenses. For those of you who don’t already know, you can view the splits of a transaction by holding down the Alt key and hovering over the transaction with the mouse.

Next week I’ll be posting from England with a new currency and a new cash account.

The information in this blog posts is only meant to detail my experience and should not be considered financial advice.

Making my budget dance

I’m having a lazy day in Iceland today. My travel buddy, Jon, is off hiking up a mountain and I decided to spend the day relaxing at the guesthouse and doing some serious window shopping. I’ve read in several guidebooks that Icelanders are very into fashion and design. After spending a few hours walking along Laugavegur, the main shopping street in Reykjavik, I am totally convinced. Even the used items for sale at the Red Cross second-hand shop are stylish and well-made! I’m glad that I came here at the beginning of my travels, as the knowledge that I’ll have to carry anything I buy for the next six months has restrained my shopper’s instincts a great deal. If I was heading directly home after Iceland I think I would bust my budget in the shops!

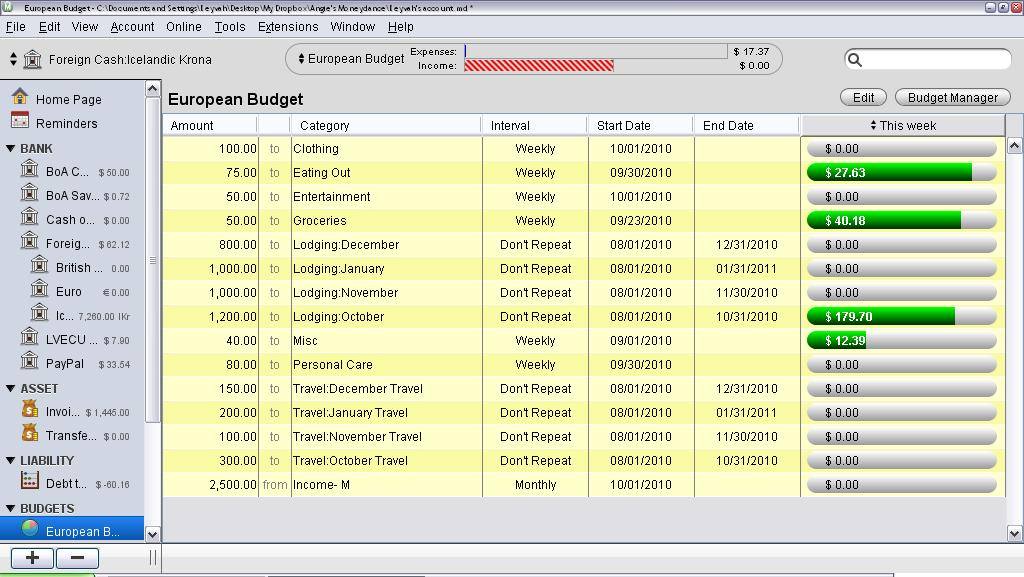

My travel budget is a great example of customizing Moneydance’s tools to meet my specific (albeit somewhat unusual) needs. When I began planning this trip I realized that I would need a detailed budget. I’m going splurge on a number of things, including a weekend in Brussels and a spa day in Budapest, so I need to be diligent about tracking my spending to make sure I don’t end up eating ramen noodles for the rest of the trip. What this means is that I need a budget which is both flexible and permits a high degree of granularity. The other complicated piece of expense tracking for this trip is that I’m prepaying about 2/3 of my hotels and train tickets. For example, in August I purchased 3 train tickets for my travels through England in October. I wanted my budget reports to reflect that these were October’s travel expenses, not August’s. To do this I created sub-categories for each month’s lodging and travel costs so I can have a clearer idea of how much I’ve already spent for each month’s expenses. I have a category named Lodging:October for which I have budgeted $1200 as a non-recurring expense. This line item begins on August 1 and ends on October 31. I have similar sub-categories for lodging and travel November, December, etc, allowing me to track how much I’ve spent for each month of the trip. I really appreciate the budgeting feature which allow budgeting intervals from daily to yearly, as for me different intervals work for different categories. Larger, less frequent transactions such as train tickets and lodging are tracked by month, but I’ve divided my eating out, grocery, entertainment, personal care, and miscellaneous categories into weekly intervals. This makes it less likely I’ll blow all of my money in the first half of each month and end up busting my budget or eating a lot of ramen at the end (or so I hope).

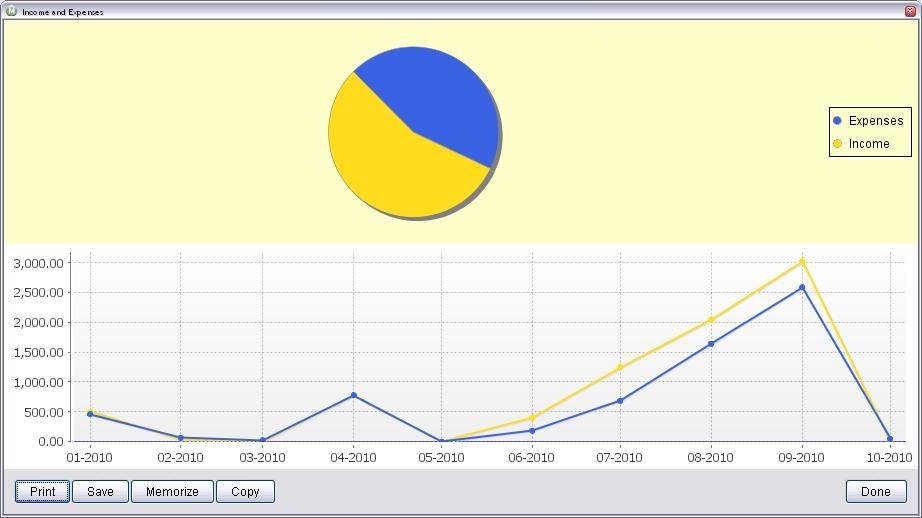

On a budget related-note, my new favorite graph is the “Income and Expenses” pie chart. It’s an incredibly clear (and occasionally brutal) visualization of how my income compares to my expenditures. If you are trying to stick to your budget, especially if you are using the zero-sum calculation method, this is a great tracking tool.

In my next post I’ll describe how I’m using liability accounts in Moneydance to help keep the finances between my travel companion Jon and I organized.

The information in this blog posts is only meant to detail my experience and should not be considered financial advice.

Krona, Pounds, and Euros, oh my!

This post is a part of the Moneydance on the Road blog series. Check out thefirst post here.

I arrived safely in Iceland Thursday morning, and apparently only narrowly escaped major delays due to the storm on the East Coast of the U.S. Reykjavik is beautiful and the weather is like none I’ve ever seen before- the sun is bright enough for me to need sunglasses but it’s also raining. Although the weather is odd, the rainbows which result from it are amazing, so I think it’s a fair trade.

I’ve found that I do much better sticking to my budget when I spend cash, so I’ll be withdrawing a chunk of cash either when I arrive in the country (as with my stay in Iceland) or every few weeks (when I’ll be in the Euro zone for months at a time). This strategy will save me the fees most banks charge on international transactions, but it will require some extra setup of my data file to accurately track this money.

While the more correct accounting setup would be to hold cash in asset accounts, cash accounts can be created as either a bank or asset accounts in Moneydance. In my Moneydance file I create my cash accounts as bank accounts. My logic is that bank accounts track liquid capital and asset accounts track not currently liquid resources such as an invoice which has been issued but not yet paid, or money which is tied up in inter-account transfers. I’ve deleted all the foreign currencies except those I am likely to use in the next 6 months- it keeps the drop down list shorter and simplifies the exchange rate interface on my home page.

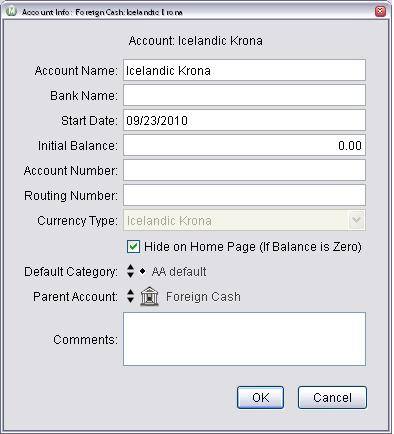

I might have several different currencies in my wallet at the same time, so I’ll first create a parent “Foreign Cash” account so I can see how much I have tied up in foreign cash. I’m also selecting the “Do Not Show on Homepage (if balance is zero)” option for all the foreign cash accounts to keep my homepage simple. Next, I’ll create cash accounts for the first few currencies I’ll be using, the Icelandic Krona, the British Pound, and the Euro.

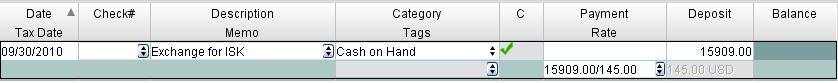

When I arrived in Iceland I exchanged $145 USD for 15,909 ISK (cash exchanges always get a pretty terrible rate). I transferred this amount from my USD based “Cash on Hand” account to my “Icelandic Krona” account. I entered the exact exchange rate by entering a ratio in the exchange rate field.

In my next post I’ll describe the process of setting up a budget for such a complicated trip, as well as explore the various graphs and reports I use to make sure I’m sticking to it!

The information in this blog posts is only meant to detail my experience and should not be considered financial advice.